Choosing the right KPI’s for Business Success

Matt Byrne

Director

Summary

Over the last couple of blog articles we’ve discussed some of the financial metrics we think businesses should be tracking to assist them in understanding the performance of their business.

In our article on revenue metrics we covered:

- Actual vs budgeted revenue

- Debtor days

- Bad debts & warranties

- Average revenue per customer

- Leads & conversions

In the next article we looked at profit metrics including:

- Gross profit margin

- Net profit margin

- Actual vs budgeted profit

These financial metrics apply to pretty much every business and are a great starting point. However, these are general financial metrics and aren’t specific to your business. If you jump on Google to do a search you’ll find hundreds of articles on different metrics. Wading through all that info can be overwhelming and it’s difficult to know which metrics apply to your business and what you should be reporting on.

So we thought we’d write this blog article to give you some information on how to choose the metrics that are right for your business.

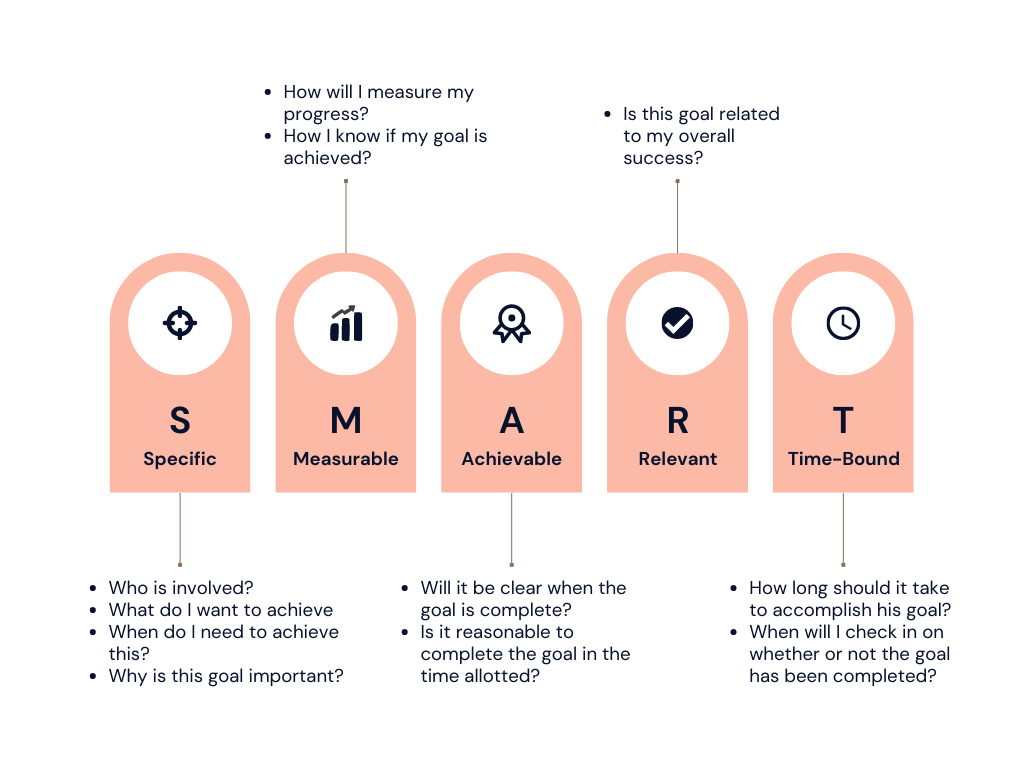

You will have heard the term “key performance indicator” or KPIs plenty of times before. KPIs are just metrics that are particularly important to your business. These could be financial metrics (such as those listed above) or they could be non-financial metrics such as website traffic. Not all KPIs are created equal. In order for a KPI to be truly effective, it needs to be SMART. That is, it should be specific, measurable, achievable, relevant, and time-bound. A KPI that meets these criteria will be much more useful than one that doesn’t. The SMART framework for creating effective KPIs can help you make sure that your key performance indicators are not only meaningful but also achievable.

Our hope is that this article helps you choose the metrics which are key to your business so you can start reporting on them and improving your businesses performance.

Step 1: understand your goals.

Before you can pick the KPIs and start reporting on them you have to understand what your objectives in business are. This could be anything from increasing revenue to working less hours. Understanding the end goal will help you identify what needs to be done to meet that goal.

Here are some examples of common goals we see from our clients:

Example 1: Maintain current revenue but work less hours.

Example 2: Increase revenue and profit.

Example 3: Increase value for sale.

At the end of the day the goals you set are relevant for you and your business so it’s important to spend some time thinking about what is important for you.

Step 2: Understand your drivers and pick KPIs

Next you need to really understand the drivers behind each of your goals. These are the key things that need to be done to achieve your goal. There could be one or 100 but best to have 3 or less that have the most impact and nail those ones first before you cast the net wider. Those drivers then become the KPIs that you report on.

Taking the examples before, here are some possible drivers and the KPIs:

Goal

Maintain current revenue but work less hours.

Drivers

Total chargeable hours, average hourly rate, write-offs/non-recovered hours.

KPIs with targets

32 chargeable hours per staff per week, average hourly rate of $250 up from $150, <5% write-off.

Comments

In this example the goal is to work less without making less money. Assuming this is a service-based business, they generally charge by the hour so the way to make the same amount of money while working less is to increase the effective hourly rate. We generally find businesses like this need a two-pronged approach:

1. Charge more per hour. Often businesses haven’t changed their pricing for years so the starting point is to make sure you’re charging what you’re worth.

2. Recover all time. Service based businesses often quote based on estimated hours taken to complete a job but those quotes are often a bit optimistic on the time required so a job quoted for 5 hours might actually take 7 on average and you’re only charging 5. Those 2 hours that aren’t billed reduce the effective hourly rate.

The way a business like this would maintain revenue while working less is to set targets on how many chargeable hours each staff member is working and make sure that time is actually billed to the client so that write-offs are lowered. The impact of this, combined with a review of pricing, results in higher effective hourly rates and therefore more revenue without needing to work more hours.

For this business, they should be maintaining timesheets and then reporting on actual time compared with billed amounts.

Goal

Increase revenue and profit.

Drivers

Visitors and conversion rate, average order value, write-offs/non-recovered hours.

KPIs with targets

1,000 visits per day with 3% conversion, average order value of $80 up from $50, customer acquisition cost <$10 down from $15.

Comments

Ecommerce businesses tend to be high volume businesses so the traffic through the website is very important. However, increased traffic isn’t any good if those people aren’t buying so for this business, it will be important to increase traffic but also increase conversions which will translate to higher revenues. Increased conversion rate could come from improved mobile optimisation, updates to branding and imagery, better customer targeting, the list goes on.

In addition to increasing visitors and conversions they will also want to track order value. If a customer is already on your website, increasing their purchase from $50 to $80 gives you additional revenues without having to acquire new customers. This could be achieved through strategic discounts or additional offers during checkout.

Finally, this business also wants to increase profit while increasing revenue so they’ll need to watch their customer acquisition costs. There is no point getting more customers if those customers cost you as much as your gross profit on the sales you make to them. I expect you’ll find that with improved conversion rates and increased average order volumes this business would lower their customer acquisition costs anyway but they may also want to ensure their ad spend is optimised and they’re targeting the audience most likely to convert.

Goal

Increase value for sale.

Drivers

Earnings before interest and tax (EBIT), owner on the tools, processes and reporting.

KPIs with targets

Owner not ‘on the tools’, increase EBIT by 25% YOY, average customer rating of 4.8 stars.

Comments

This goal is a bit complicated to work through as it will depend on your business and how it’s valued. For this example, we’ll assume the business owner is an electrician but this will apply to any trade as well as plenty of other businesses.

Trades are often hard businesses to sell as the owner is generally on the tools and value comes from the reputation of the individual rather than the business. If that person steps away and the phone stops ringing then there isn’t anything worth buying. Therefore, to sell an electrical business it’s important that it becomes a business rather than a person. The business owner needs to get off the tools and put in place processes and procedures so the business can run and make a profit without being dependent on the owner.

Replacing the owner with staff is the starting point so the owner can start focussing on running a business rather than being an employee. From there, processes and procedures can be implemented to improve efficiency and quality and reduce rework ultimately resulting in improved experience for customers and repeat business.

Once the owner is off the tools the next step is to systemise the quoting process so customers can call and discuss business with any employee rather than having to talk to the owner all the time.

Businesses are often sold on a multiple of their earnings before interest and tax (EBIT) which is just their profit with some adjustments. Increasing EBIT ultimately increases value so you’d want to review your pricing, make sure you’re recovering all of your employee’s time and reducing unnecessary costs.

As you can see from the above it’s not a simple process to determine the KPIs and set targets and every business will have a different outcome based on their goal and their business. As a result it’s very important to do a deep dive to understand your goals and what changes will be required for you to meet those goals.

Step 3: report on performance

Once you’ve set the target for your KPIs the next step is to report on your performance against the target regularly. For some KPIs this might be monthly while others might need more frequent reporting. Where your actual results differ from the target you then need to understand why and make changes to get back on track.

Final Thoughts

If you need help understanding what KPIs apply to your business or what targets you should be aiming for, reach out to the team at Day One Advisory. We can jump on a strategy call and help you set your targets.