The revenue metrics every business owner should be tracking

Matt Byrne

Director

Summary

The move to cloud based accounting software such as Xero and Quickbooks means that businesses have access to a huge amount of financial data. Despite that, there are plenty of businesses out there that aren’t using that data to their advantage. This is likely because they don’t have time or because they don’t know what data to look at and how to translate it into practical and actionable advice.

In this article (and some more to come this month) we’re going to try and tackle that second issue by giving you some key metrics that are worth looking at. This article looks at revenue related metrics that we think all businesses would benefit from.

Before we get into the specific metrics it’s worth noting that reporting on these metrics is only one part of the puzzle. The metrics merely highlight the high-level performance of the business but don’t really give the underlying reasons for that performance. It’s the WHY that is the really important piece and what you ultimately need to ask and understand.

What the metrics do is help you know what needs to be looked at in more detail. For example, let’s say you sell products and have a warranty claim of 5% for a month and that’s above the target of 3%. That stat alone doesn’t give you much info except for the fact that you need to look into it. Digging down into the data will give you the reasons why you’ve got a higher warranty. In this example it could be a change in material, manufacturer or delivery that is causing damage that you can then correct and improve.

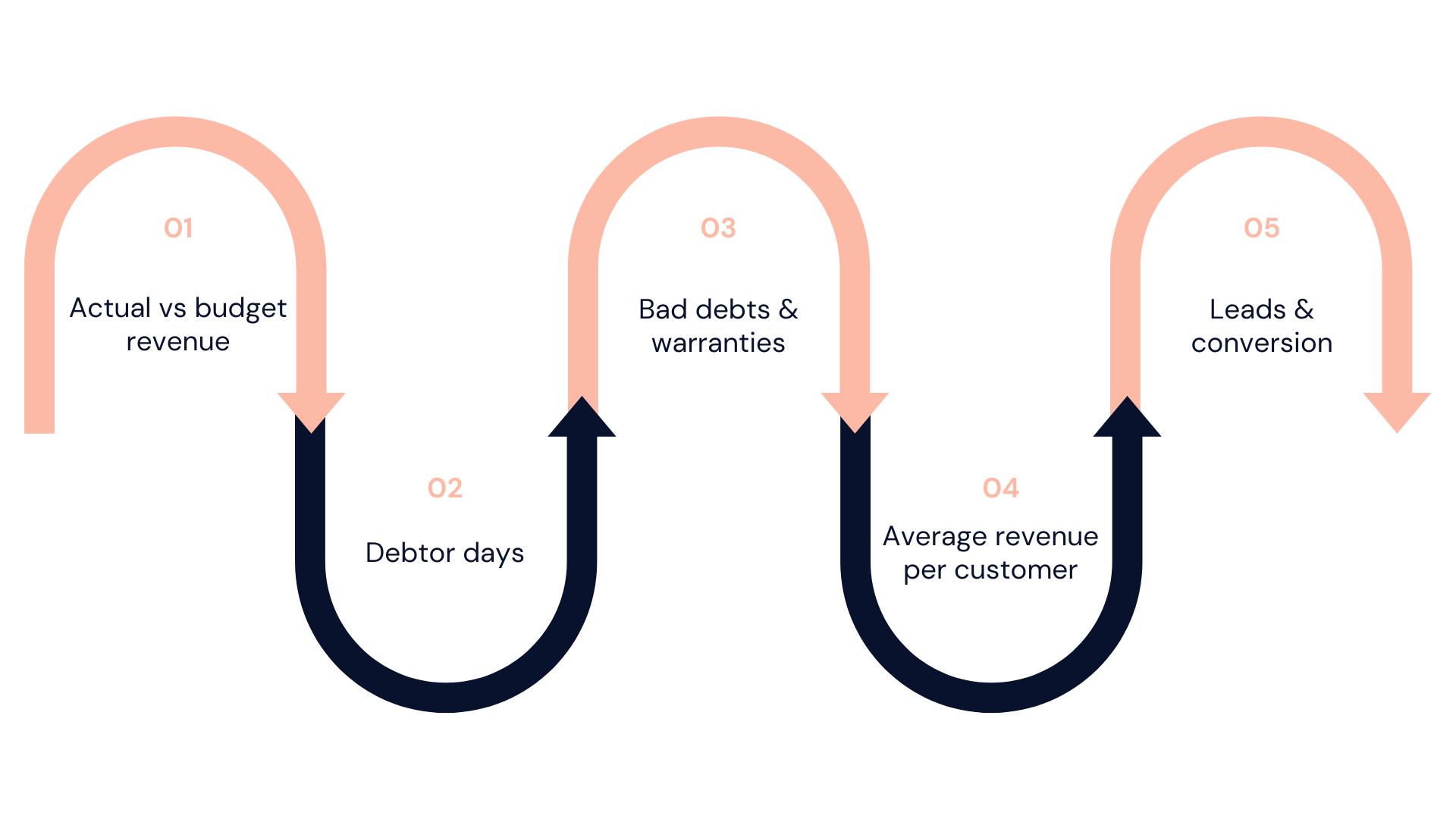

Now, let’s have a look at five revenue metrics we think you should be looking at. These work for both service and product based businesses so this should apply to one and all.

Actual vs budget revenue

A quick search on Google will reveal plenty of articles on financial metrics and most will start with tracking revenue. Tracking your revenue is one thing but without something to compare it to, you don’t have the full context. For example, if you did $100k for a month that might sound great in isolation, but if your target was $150k because you’ve added additional advertising costs then $100k doesn’t look very good.

Tracking actual revenue against budget is the starting point, and in our opinion, a must do for all businesses. A budget is a financial target set for a business over a period of time (usually 12-months). A good budget is well researched with a detailed understanding of the drivers behind revenue resulting in a realistic and achievable target. If you don’t have a budget, do one now!

The key in reporting actual vs budget is to dig down to understand why you had a variance to budget (that could be both a good or bad variance) and then determine what needs to be actioned to either improve your position or continue the good trajectory.

Here are some examples to look at if your actual revenue is below budget:

- For service based businesses, look at the actual chargeable hours for staff. Did you have more leave than usual, were staff underutilised, was there some business development that took time away from client work?

- Did you invoice work in a timely manner or were you carrying a large work in progress balance at month end? If your invoicing rolled into next month it might be worth recording your work in progress in your profit and loss to align revenue with the period in which the work was performed.

- Maybe traffic was down on your website resulting in fewer conversions. Underlying causes could be a drop in advertising spend or poor targeting, downtime on the website, a competitor releasing a similar product or outbidding you on Google adwords.

Every business is unique and reasons for budget vs actual variances will be entirely circumstantial. However, if you understand your numbers and the drivers in your business, you’ll be able to quickly draw a conclusion and implement changes.

Debtor days

How to calculate

Debtor days is the number of days it takes you to get paid from the date you issue the invoice.

It’s one thing to invoice a customer and report the revenue on your profit and loss statement but it’s another thing altogether to have the cash in your bank account. Cash is the lifeblood of any business and getting paid on time is vital.

Debtor days is the number of days it takes you to get paid from the date you issue the invoice. Lower debtor days means you’re getting paid faster so you want to keep that number as low as possible and definitely on or below your standard payment terms.

Check out our guide on cashflow management which includes some great tips to get paid faster.

If you’re a Xero user, you can calculate your debtor days using the ‘Receivable Invoice Summary’ report. Make sure that you have both the invoice date and last payment date columns selected and then export this to excel. From there, run a quick formula to calculate the difference between your payment date and invoice date, that’s your debtor days. You can then look at average debtor days by customer over the period to see who your problem clients are.

Bad debts & warranties

Tracking your bad debts or warranty claims is another metric to track whether your revenue is actually converting to cash. There is no point bumping up sales if it results in a drop in quality and an increase in write offs of that revenue either via bad debts or warranty claims.

If your bad debts (invoices you’ve issued but don’t get paid for) are increasing it’s vital you understand why. If you don’t, you could be doing great work that you’ll never be paid for. Here are some possible reasons for bad debts:

- A problem client could be contributing to the bad debts. Going forward, take a deposit from that customer or make them pay upfront. If they don’t want to, it might be time to cut them off altogether.

- If customers are disputing invoiced amounts it may be an engagement and communication issue. Consider how you’re communicating fees with clients throughout the whole engagement and see if there is an improvement. We’ve found that issues are less likely if you are transparent and upfront about fees.

Warranties apply both for product based businesses but also service based businesses where there is rework required. If warranty claims are increasing it’s generally a quality of product or work that is the issue. For businesses that send products it could be the product but it could also be damage during shipping. Where there is a warranty claim, ensure that you’re understanding what it is for and you’ll quickly spot a trend that can be fixed.

Average revenue per customer

How to calculate

Your average revenue is the amount of revenue you make per customer calculated as the revenue divided by number of customers.

For a high volume product bases business (i.e. ecommerce) that’s about as far as you need to go with the calculation. Increasing the average revenue per customer ultimately results in higher revenue without needing to generate additional leads so tracking this and then testing methods to increase average revenue will help you increase revenue. If you’ve done your grocery shopping online before you’ll notice that during the checkout process they offer you additional products that you’ve bought before and may have forgotten. This tactic would result in an increase in average revenue per customer and plenty of testing would’ve been done to understand where in the process the offers were made and what type of products are offered.

For a service based business, a business with lower volume sales or businesses with recurring/returning customers you should be going a step further with this calculation. Instead of calculating a business wide average revenue per customer, we suggest understanding the actual revenue per customer or type of customer so you can understand where there might be scope to market additional services to existing customers.

In addition to calculating the average revenue per customer, you can also calculate the average revenue per customer per type of product. This will help you understand which products are selling better for each customer and then you can use this data to market those products or services to other customers.

Leads & conversion

To grow a business you ultimately need a pipeline of work to keep everyone busy. This pipeline starts with leads and your ability to convert those leads into paying customers.

If you know your conversion percentage (i.e. 5% = for every 100 leads you convert 5) and your average revenue per customer then you can work out how many leads you need to generate to meet your revenue target in your budget.

For example, let’s say your target revenue in the budget is $100k, your average revenue per customer is $500 and your conversion rate is 5%. You can calculate the number of leads required as follows:

You can calculate the number of leads required as follows:

$100k / $500 per customer = 200 customers

200 customers / 5% conversion = 4,000 leads required

Conversely, you can also estimate your future revenues based on the number of leads.

To track leads and conversion properly, you’ll want to know the number of leads actually coming in and their source, and your actual conversion rate. You can then investigate any variances between targets and compare month on month changes.

Final Thoughts

The above are just some of the examples of financial metrics specific to your revenue. Ultimately the point of reporting on these metrics is to better understand the drivers in your business so you can make better, informed decisions.

If you need help with that exercise or just want a sounding board, reach out to the team at Day One Advisory.