How to make 2023 the year your business reaches its full potential

Matt Byrne

Director

Summary

Christmas is less than 3 weeks away (WHAAAAT!!!!!) and some lucky business owners are finishing off jobs for the year and winding down to some time off. The holiday break is a great time to reflect on how you went during 2022 and turn your mind to 2023 and what you’re hoping to achieve.

2023 predictions

%

of Aussie mortgages will move to variable rates by the end of 2023

NAB are forecasting an additional 0.75% increase in the cash rate from December through February further increasing variable home loan rates.

It’s our opinion that 2023 is going to be a difficult year for personal and business finances for the following reasons:

- The RBA estimates that ~23% of Aussie mortgages are fixed and will move to variable rates by the end of 2023 increasing interest rates from ~2% to ~5%. On a 30 year, $500k mortgage that’s an increase in monthly repayments of $836 which is going to start to hurt. Only about 20% of fixed rate mortgages have moved to variable so far.

- NAB are forecasting an additional 0.75% increase in the cash rate from December through February further increasing variable home loan rates

- The RBA are expecting unemployment to remain low at 3.75% through to the end of 2023 keeping pressure on the labour market.

- While inflation is expected to drop during 2023, high energy prices will keep pressure on household budgets.

- House prices are estimated to drop by 11% by the end of 2023.

For the past decade we’ve enjoyed low interest rates, increasing house prices and relatively modest inflation resulting in healthy disposable income and spending. Increased pressure on household budgets is going to eat away at savings and require reduction in spending (which will be difficult given we haven’t tightened the purse strings for a decade).

For business owners 2023 is going to be an interesting year. All of the above factors will likely reduce demand and put pressure on profits. For those reasons, it’s vital for businesses to understand their financials and the drivers behind their business and its success.

To help you get the most out of 2023 financially we’ve pulled together some tips on things you can do over the break to set yourself up for success.

Goal setting

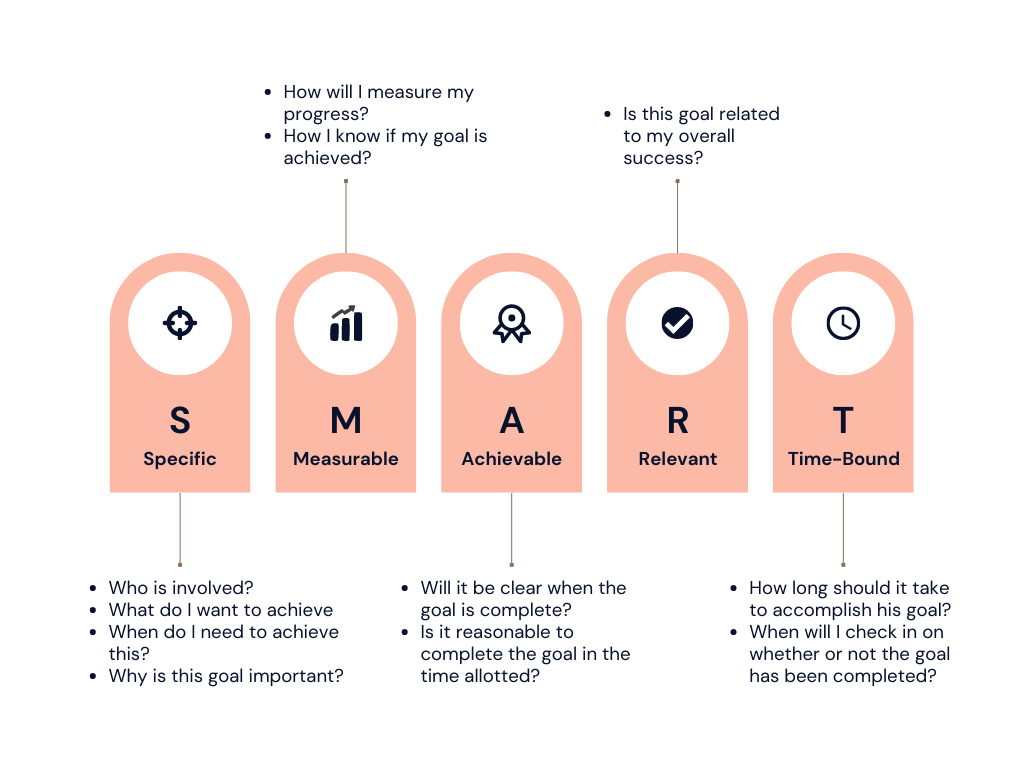

Setting out your goals for the business is a great tool to help you break down tasks that will ultimately get you to that goal. By identifying the tasks you can work with purpose and know that what you’re doing on a day to day basis is helping you achieve the long term goals. In order for a goal to be truly effective, it needs to be SMART. That is, it should be specific, measurable, achievable, relevant, and time-bound. A goal that meets these criteria will be much more useful than one that doesn’t. The SMART framework for creating effective goals can help you make sure that your long term goals are not only meaningful but also achievable.

When goal setting we suggest you start with the big picture long term goals and then work backwards. Here are a couple of examples to help illustrate that point:

Let’s say your overarching goal is to build the business so that you can sell it in 5 years with enough cash to retire on. If you need $5m to retire and businesses in your industry sell for 5x profit then you know in 5 years you need to be making annual profits of $1m to meet that goal. If your current profit is $200k then you know you need to add an extra $160k profit per year for 5 years to get there.

In this example, your goal is to create a business that generates income without needing your involvement on a day to day basis. To achieve this you need to either systemise or delegate all tasks that you currently do while still maintaining enough profitability so you can make a living. By writing down all your tasks you can then prepare a timeline for how you’re going to offload that work.

Once you have the big picture goals and roughly what needs to be done to achieve it you can then start breaking that down into smaller tasks. Figuring out the timeline of when those tasks will be done then gives you an idea on what you need to do over the next year.

Prepare a budget

Every business should have a budget. It’s the financial map for your business and helps you understand where you’re heading. The budget should factor in the financial targets required to meet your goals for the year.

When creating the budget, make sure you put some science behind the numbers. This requires that you get down into the weeds and understand the drivers behind the revenue and costs.

Once you’ve got your budget in place, the next step is to run variance analysis on a monthly basis to see how the business is performing against the budget. Your budget is ultimately just a bunch of educated guesses so you’re not going to hit it every month but by understanding your variances, you’ll understand how your business is tracking and you can make adjustments to your cashflow accordingly.

Identify KPI’s

As part of the budget process you will necessarily need to understand the drivers behind your business. These drivers ultimately become your key performance indicators (KPIs). KPIs are just financial or non-financial metrics that have the most impact on your business.

For example, a service-based business that charges for hours worked by staff could have a KPI of total chargeable hours per week per staff with a target of 80% chargeable.

As another example, an ecommerce business may have KPIs of number of visitors per day and conversion rate.

Identifying the KPIs relevant for your business and then setting targets will give you something to report on and compare performance against. It will help you understand what is working and what isn’t which, when actioned appropriately, will help keep you on track for your goals.

Create an org chart

Creating an organisation chart is more than just drawing a diagram of the hierarchy of the people in the business. A proper org chart assigns roles and responsibilities to each person, team or division so that everyone knows what they need to do.

As a business owner you often take on everything and then delegate when you can’t carry the workload any longer. An org chart will help show you what tasks you’re currently doing and identify those tasks that could be better suited to another member of your team. This process may also help identify where additional team members are required so you can recruit intelligently and hire staff that will add value.

Ultimately this process helps you to ensure you’re using your time wisely. After all, time is the scarcest resource you’ve got.

Stay accountable

It’s all well and good to go through the above process, do some planning and put in place action items but that isn’t useful if you don’t follow through with the actual doing. You need to stay accountable to what you said you’d do.

Here are some tips to help you stay accountable:

- Get an accountability coach. This could be a family member, a friend, a mentor, regular team meetings or it could be someone external that you pay. Whoever it is, meet regularly, share openly and be honest about what you’ve done and haven’t done. By having to explain to someone else why something wasn’t done you’ll quickly find the more comfortable and easier option is to just do what you said you would.

- Write manageable to do lists. If as business owners, we wrote down every task that needed doing into one list that list would go for pages, and it quickly becomes overwhelming. For me personally, I like to write down no more than six things per day consisting of one difficult/time consuming task, two moderately difficult pieces of work and three easy wins. I find getting through those six things with purpose means I’ve done more at the end of the week than I would have with a very long list of all the things to be done.

- Celebrate your wins. Whether it is a big or small win, you should be celebrating because this builds momentum and helps you stay focused.

Need some help?

Looking at the new year in large scale can be overwhelming but with Day One Advisory on your side it doesn’t have to be.

We know that having the right financial plan is crucial to achieving your potential, so we’ve created our 2-Hour “Make It Happen” Strategy Package just for that purpose. Think of it as a bridge between goal and completion.

This limited time package includes:

- 2-hour strategy call

- Goal setting

- Budget preparation for 2023 calendar year

- Add budget to Xero

- Preparation of management report template to track actual vs budget

Our goal is to give you full ownership over both big picture strategy and detailed financials so that no matter what comes across your desk each day, you will be well informed and confident about every decision you make. Unleash your motivation and get going with Day One Advisory today!