The business owner’s guide to paying tax

Matt Byrne

Director

Summary

There are plenty of weird and wonderful things that businesses owners need to get their head around when starting out in business. One of those things is tax.

When you’re an employee your employer basically deals with your tax for you and at the end of the year, you’d usually get a small refund. For most employees, tax is just something that happens in the background that they don’t have to give too much thought to. For business owners, it’s a whole different kettle of fish.

Business owners are responsible for their own tax as well as the tax for their employees. For this article we’re only going to deal with how business owners pay their own tax. We’ll save employee tax for another day.

There are a few key ways that business owners pay tax:

- After lodging a tax return

- Through the PAYG instalment system

- By employing yourself in your business

- Dividends

The way you pay tax is ultimately going to depend on your business structure but before we break it down by business structure it’s worth making some general comments about how the PAYG instalment system works.

The PAYG instalment system

Once you’ve lodged your first tax return as a business owner that has a tax liability (whether that’s your personal tax return or a company tax return) the ATO is going to want you to start paying your tax by instalments rather than a lump sum at the end of the year.

Enter the PAYG instalment system.

PAYG stands for pay as you go which is just some lingo for ‘pay your tax earlier’. The system is really designed so that business owners pay tax in smaller instalments rather than large one-off payments which they are more likely to default on. After all, growing a business is expensive and most cash is reinvested rather than saved for tax. By paying each quarter, at least some money is set aside to cover part of the tax bill at year end.

Let’s use an example to show how it works in practice:

Example Case

Assume Janet has been in business for a couple of years and lodges her tax return for the year ended 30 June 2022. That tax return resulted in a tax liability of $20,000 which she has to pay in one lump sum after lodgement. Rather than pay all tax in another lump sum payment next year, the ATO puts Janet into the PAYG instalment system and now requires Janet to pay $5,000 in her BAS each quarter as an instalment to her year end tax liability.

If Janet lodged her tax return in November, it’s likely that her first PAYG instalment will be in the March quarter. If she pays $5,000 for March and another $5,000 for June that means she’s paid $10,000 for the 2023 financial year. Assuming Janet’s tax liability for the 2023 year is $30,000, she’ll get to deduct the $10,000 she’s already paid and will be left with $20,000. Once that tax return has been lodged the ATO will increase her PAYG instalments and she’ll need to pay more tax every quarter.

If Janet’s business stops growing, eventually she’ll get to the point where her instalments equal her year end liability and she shouldn’t need to make any top up payments after lodging her return.

One aspect of the PAYG instalment system that is a cashflow headache for businesses is that PAYG instalments generally start as you’re paying a lump sum payment for the previous year. Take Janet’s example above, that initial $20k tax payment for 2022 is likely to land around the same time as her first PAYG instalment of $5k so within a short period Janet has forked out $25k with $5k of that being for the next year. While there isn’t much you can do about that, proper tax planning will at least highlight the upcoming tax payments which will help you manage your tax liability.

Finally, I also want to note that PAYG instalments aren’t just general credits that you can apply against any tax liability. The PAYG instalment is for a specific quarter and whatever financial year that quarter happens to be in, that’s the year the instalment relates to. So if you’ve got a bill from 2022, you can’t apply the March 2023 instalment against it. The March quarter instalment is in the 2023 financial year so goes against the 2023 financial year tax liability.

Clear as mud? Good, let’s now talk about how you pay tax as a sole trader, company and trust.

Sole trader

As a sole trader, you and the business are one in the same. There is no legal separation and for tax purposes the business is you and you are the business.

The profit you make through your business is included in your personal tax return and you’ll pay tax on that income no matter how much you make. When you lodge your tax return at the end of the year you’ll pay tax based on how much you earn. For the first year or two in business this tax will be a lump sum so best to make sure you have some cash set aside.

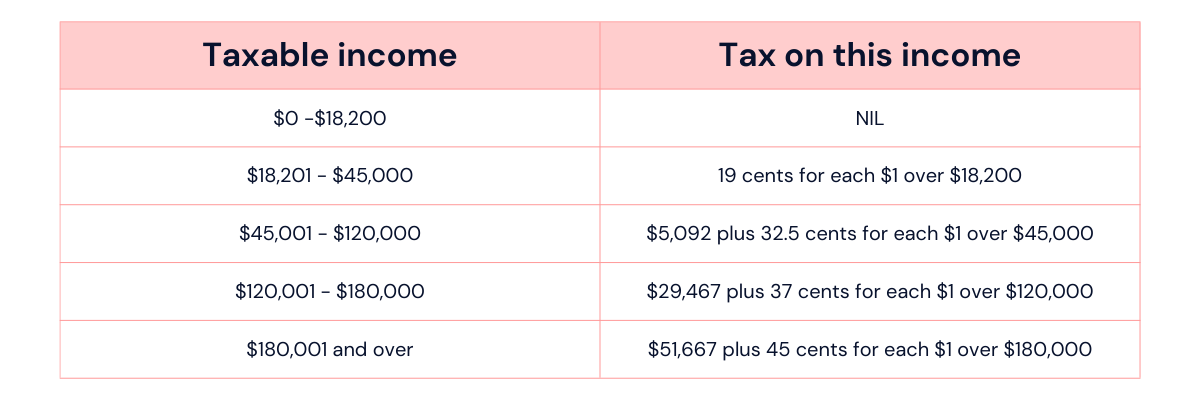

Tax for individuals is calculated on a tiered system and the current tax rates are listed above.

Once you’ve paid tax you’ll then be in the PAYG instalment system and will need to pay instalments towards your year end tax liability on a quarterly basis.

Discretionary or family trust

A trust is a complicated structure to get your head around but basically a trust is just a relationship where a person or company (the trustee) operates a business for the benefit of you and your family (the beneficiaries).

At the end of the financial year, the trust distributes the profit to the beneficiaries however the trustee sees fit and the beneficiaries pay tax on their share of the profit (irrespective of whether they’ve received the cash). If the beneficiary is an individual, they pay tax using the tiered system outlined in the sole trader section above and will ultimately end up in the PAYG instalments system if they continue to receive distributions.

If the beneficiary is a company, the below company section will be relevant.

In addition to distributing the income to the beneficiaries, the trust can also employ you and will need to withhold tax and pay super like it would for any employee. Each pay period (i.e. every week, fortnight or month) the trust will process payroll and will withhold tax from your wages. Each quarter the trust will pay the tax withheld to the ATO in the BAS. At the end of the year you, as an employee, will include the wages in your taxable income but you’ll get a credit for the tax withheld by the trust.

Wages paid by a trust to an employee are deductible which will ultimately reduce the trust’s profit and the amount that is included in the beneficiary’s taxable income as a distribution.

Depending on how you structure it, you may have both wages and a distribution so adequate tax planning is a must.

Company

Legally, and for tax purposes, a company is a separate entity from the owners and unlike a trust that distributes all income to the beneficiaries, a company retains its income and pays tax at the company rate.

SME companies generally pay tax at a rate of 25% on the profits so if the company makes $100k, it will pay $25k to the ATO once it lodges its tax return. After the first year where there is a tax liability the company will be put into the PAYG instalment system and will need to pay tax quarterly in its BAS.

As the business owner you also need to take some cash out of the company so you can pay the rent/mortgage, eat some food and generally get on with life. This happens in a couple of ways that are relevant for this article:

Wages

The company can employ you and will need to withhold tax and pay super like it would for any unrelated employee. Each pay period (i.e. every week, fortnight or month) the company will process payroll and will withhold tax from your wages. Each quarter the company will pay the tax withheld to the ATO in the BAS. At the end of the year you, as an employee, will include the wages in your taxable income but you’ll get a credit for the tax withheld by the company.

Wages paid by a company to an employee are deductible which will ultimately reduce the company’s profit and the tax it needs to pay.

Dividends

Dividends are the way in which a company distributes the profits it has made. For most businesses, these will be profits the company has already paid tax on. Because we like to complicate things, there is also the franking credit regime that comes into play for dividends. The easiest way to explain this is with an example.

Let’s assume the company has made a profit of $100k on which it has paid $25k tax leaving $75k of retained profits in the company.

In the next year, the directors decide to declare a dividend of $75k and they distribute that dividend to the shareholders (the ultimate owners of the business). The shareholders include the $75k in their income as well as the $25k franking credit so they pay tax on $100k of income. However, because the company has already paid tax, the shareholder gets a credit of the $25k and will either get a refund or have to pay some more tax depending on the difference between their tax on the $100k and the franking credit.

In Summary

Hopefully the above has helped you understand how you’ll need to pay tax as a business owner. Below is a quick summary based on each structure:

Sole trader

- You pay tax on the business profit once you lodge your personal tax return.

- After your first tax liability, the ATO will put you in the PAYG instalment system and you’ll need to pre-pay tax quarterly.

Trust

- The trust distributes the profit to the beneficiaries and it’s the beneficiaries that pay tax on their share of the profit.

- The beneficiaries will need to start paying their tax via PAYG instalments eventually.

- A trust can employ you and withhold tax from you wages which will be paid to the ATO quarterly in the BAS. You’ll get a credit when lodging your tax return for the tax paid by the trust.

Company

- A company pays tax on the profits it makes at 25% (generally).

- A company can employ you and withhold tax from you wages which will be paid to the ATO quarterly in the BAS. You’ll get a credit when lodging your tax return for the tax paid by the company.

- The company can declare a dividend which is distributed to the shareholders. The shareholders will pay tax on the dividend but will get a credit for any tax paid on that income by the company.

Final Thoughts

If you’re new to business or having trouble managing your tax obligations, then proper tax planning can not only alleviate stress but also contribute to the growth and success of your business. Proper tax planning helps you stay organised and on top of important deadlines, while also ensuring that you are maximising any potential deductions and credits.

If you need help with that exercise or just want a sounding board, reach out to the team at Day One Advisory.